Previously, Wealthsimple Trade used to label their Non-Registered accounts as Personal accounts. Renaming it as Non-Registered provides more clarity to minimize confusion among new users in the platform, since the term aligns with the general industry lingo.

What is a Non-Registered account?

In Canada, a Non-Registered account is a common term used by financial institutions and the CRA (Canada Revenue Agency). It refers to an investment account, where earnings made within it are usually taxable and should be reported in your annual tax returns.

What about a Registered account?

Investments owned inside registered accounts usually offer some kind of tax benefits. The most common examples of registered accounts are:

- TFSA (Tax-Free Savings Account), where earnings made inside the account are generally tax-free.

- RRSP (Registered Retirement Savings Plan), where earnings made inside the account are taxable, but only when they are withdrawn (though subject to other conditions as well).

- FHSA (First Home Savings Account), where earnings made inside the account are generally tax-free like the TFSA, and withdrawals may be tax-free provided certain conditons are met to purchase your first home.

Even though there are tax benefits associated with registered accounts, there are also rules you'd have to follow, such as how much you can contribute to them each year.

In registered accounts, contributing beyond the limits you are supposed to will subject you to a penalty. This is unlike non-registered accounts, which are generally very flexible and you can deposit into or withdraw from them as you wish.

Wealthsimple Non-Registered Accounts On Desktop

Here is how the new label for the account shows up in Wealthsimple on Desktop:

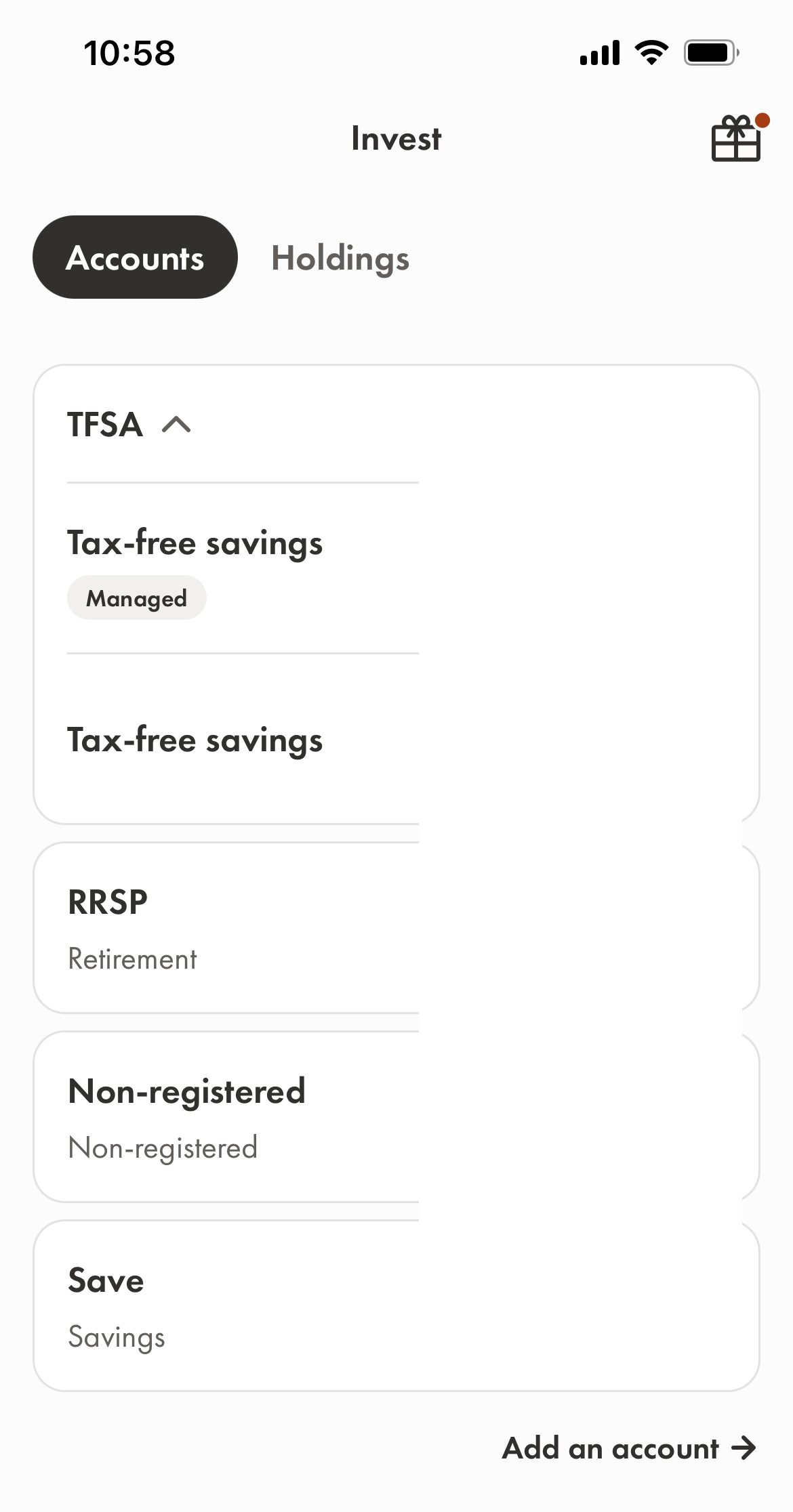

Wealthsimple Non-Registered Accounts On Mobile